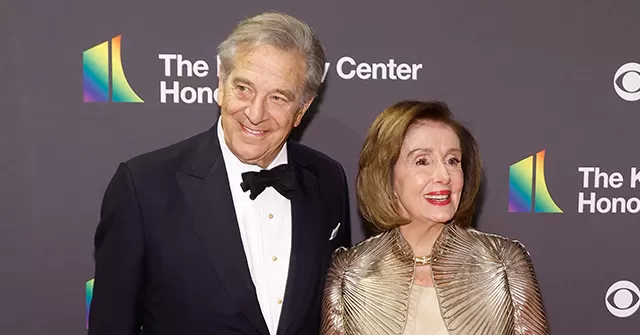

Former House Speaker Nancy Pelosi (D-CA) and her husband, Paul, have been making headlines recently for their significant wealth and extensive stock trading. Many have raised concerns about the couple’s financial success and whether it is the result of insider knowledge and unfair advantages.

In an exclusive interview with “The Alex Marlow Show,” Senator Josh Hawley (R-MO) shed light on the Pelosi’s extensive stock trading and how they have managed to beat even the most successful hedge funds.

According to Senator Hawley, the Pelosis have amassed hundreds of millions of dollars through their stock trading, thanks to Nancy’s insider knowledge and connections. This has raised serious questions about conflicts of interest and the fairness of the stock market.

But Senator Hawley has a plan to put an end to this unfair advantage. He believes that members of Congress, including Nancy Pelosi, should not be allowed to trade stocks while in office. He argues that this would level the playing field and prevent politicians from using their insider knowledge for personal financial gain.

The Senator’s proposed legislation, the “No Stock Trading for Congress Act,” would prohibit members of Congress from buying or selling individual stocks while in office. Instead, they would be limited to investing in mutual funds or exchange-traded funds.

This move would not only address concerns about conflicts of interest, but it would also restore public trust in the government. As Senator Hawley stated in his interview, “The American people deserve to know that when members of Congress are making decisions, they are making them in the best interest of the country and not their own wallets.”

The Pelosis’ extensive stock trading has been a topic of scrutiny for years. In 2010, Nancy Pelosi was accused of participating in insider trading after purchasing stock in Visa while a bill that would benefit the company was being considered in Congress. She denied any wrongdoing, but the incident raised red flags and sparked a call for stricter regulations for politicians.

Despite the controversy surrounding their stock trading, the Pelosis have continued to amass significant wealth. According to a financial disclosure report, they have a net worth of over $100 million, making them one of the wealthiest members of Congress.

In comparison, the average American household has a net worth of just over $100,000. This stark contrast highlights the need for regulations to prevent politicians from using their positions for personal financial gain.

Senator Hawley’s proposed legislation has gained support from both Democrats and Republicans, showing that this issue transcends party lines. It is a necessary step towards restoring public trust in our government and ensuring fairness in the stock market.

In addition to prohibiting individual stock trading, the “No Stock Trading for Congress Act” would also require members of Congress to disclose their trades within 30 days. This would increase transparency and hold politicians accountable for their actions.

As Senator Hawley states, “This is not about punishing anyone, it’s about restoring trust in our government.” By implementing these regulations, we can ensure that our elected officials are working for the best interests of the country, not their own financial gain.

In the midst of a pandemic and economic crisis, the American people are looking for leaders who prioritize their needs above their own personal wealth. Senator Hawley’s proposed legislation is a step in the right direction and sends a powerful message that our government is committed to serving the people, not their own interests.

In conclusion, the Pelosis’ extensive stock trading and significant wealth have raised serious concerns about conflicts of interest and fairness in the stock market. However, Senator Josh Hawley’s proposed legislation offers a solution to this issue and aims to restore public trust in our government. It is time to put an end to insider trading in Congress and ensure that our elected officials are working for the American people, not their personal financial gain.