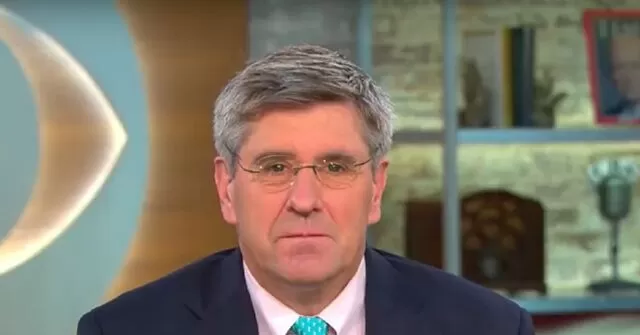

In a recent broadcast on Fox Business Network’s “Bottom Line,” former Trump Economic Adviser Stephen Moore made a bold statement about the Federal Reserve’s impact on the economy. Moore asserted that the Fed’s decision to keep interest rates high has had a negative effect on the economy, and that the “tariff turmoil” has only added to the problem.

Moore’s comments come after the release of the latest job numbers, which showed a slight increase in unemployment and a slower rate of job growth. Many experts have pointed to the ongoing trade tensions between the United States and China as a major factor in the slowing economy. However, Moore believes that the Fed’s actions are equally to blame.

According to Moore, the Fed’s decision to raise interest rates has made it more difficult for businesses to borrow money and invest in growth. This has led to a slowdown in job creation and economic expansion. Moore believes that if the Fed had kept rates lower, businesses would have been able to take advantage of the strong economy and create more jobs.

But it’s not just the Fed’s interest rate hikes that have hurt the economy, according to Moore. He also points to the “tariff turmoil” as a contributing factor. The ongoing trade tensions between the U.S. and China have caused uncertainty in the market, making it difficult for businesses to plan and invest for the future. This has led to a decrease in business confidence and a slowdown in economic growth.

Moore’s comments have been met with mixed reactions, with some experts agreeing with his assessment and others questioning the impact of the Fed’s actions. However, one thing is clear – the economy is facing challenges, and it’s important for leaders to work together to find solutions.

In the midst of this economic uncertainty, it’s important to remember that there are still many positive signs for the U.S. economy. Unemployment remains at historic lows, and wages are on the rise. The stock market is also performing well, which is a strong indicator of overall economic health.

But there is no denying that the recent job numbers are cause for concern. It’s clear that something needs to be done to stimulate job growth and boost the economy. And according to Moore, that starts with the Fed’s decision to lower interest rates.

In conclusion, while the trade tensions with China may be a contributing factor to the recent job numbers, it’s clear that the Fed’s actions have also played a significant role. As the economy continues to face challenges, it’s important for leaders to work together and make decisions that will benefit the American people. And as Moore suggests, that may mean reevaluating the Fed’s current stance on interest rates in order to stimulate job growth and keep the economy moving in the right direction.