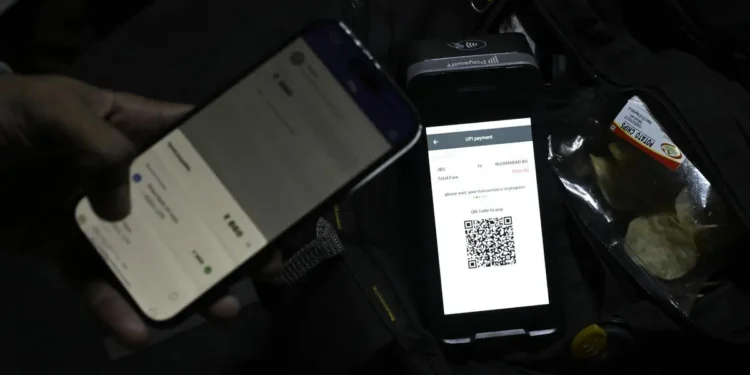

In recent years, India has seen a significant growth in the digital payments sector, with the introduction of Unified Payments Interface (UPI) being a game-changer. UPI, a real-time payment system developed by the National Payments Corporation of India (NPCI), has revolutionized the way people make transactions in the country. With its easy-to-use interface and secure technology, UPI has gained immense popularity among the masses. And now, with the latest projections, it is expected that by FY29, UPI will handle a whopping 439 billion transactions annually.

This projection, made by the Reserve Bank of India (RBI), is a testament to the success and potential of UPI in the Indian market. The rapid growth of UPI can be attributed to its convenience, speed, and security. With just a few taps on their smartphones, users can make seamless transactions, eliminating the need for carrying cash or visiting ATMs. This has not only made life easier for individuals but has also boosted the country’s digital economy.

One of the key factors contributing to the success of UPI is its interoperability. This means that users can make transactions between different banks and payment service providers, making it a universal platform for digital payments. This has also encouraged more banks and financial institutions to join the UPI network, further expanding its reach and usage.

Moreover, the introduction of UPI 2.0 has added more features and functionalities to the platform, making it even more user-friendly. The addition of features like overdraft facility, invoice in the inbox, and one-time mandate has made UPI a preferred mode of payment for businesses as well. This has not only streamlined the payment process for businesses but has also helped in promoting the government’s vision of a cashless economy.

Another significant factor driving the growth of UPI is the increasing adoption of digital payments in rural areas. With the government’s focus on financial inclusion and the rise of digital literacy, more people in rural areas are now using UPI for their transactions. This has not only bridged the gap between urban and rural areas but has also provided a boost to the country’s economy.

The success of UPI can also be attributed to the continuous efforts of the government and NPCI to promote digital payments. The launch of campaigns like Digital India and Cashless India has created awareness and encouraged people to adopt digital modes of payment. The government’s push towards a less-cash economy has also led to the integration of UPI with various government schemes and services, making it more accessible to the masses.

Furthermore, the COVID-19 pandemic has accelerated the adoption of digital payments, with people avoiding physical contact and opting for contactless transactions. This has further boosted the usage of UPI, with more people relying on it for their day-to-day transactions.

Looking at the current growth rate of UPI, it is evident that it is on track to achieve the projected 439 billion transactions annually by FY29. This will not only strengthen the country’s digital infrastructure but will also have a positive impact on the economy. With more people using digital payments, there will be a reduction in the circulation of cash, leading to a decrease in the cost of printing and managing physical currency. This will also help in curbing black money and promoting transparency in financial transactions.

Moreover, the growth of UPI will also open up opportunities for fintech companies and startups to innovate and develop new products and services. This will not only create job opportunities but will also contribute to the growth of the country’s digital economy.

In conclusion, the future of UPI looks bright and promising. With its user-friendly interface, interoperability, and continuous efforts from the government and NPCI, UPI is expected to handle 439 billion transactions annually by FY29. This projection not only showcases the success of UPI but also highlights the potential of digital payments in India. It is indeed a proud moment for the country to witness such a remarkable growth in the digital payments sector, and we can only expect it to get better in the years to come.